Ecommerce Logistics: Problems and Ways to Fix Them in 2024

White Wolf Logistics, Inc. • May 8, 2024

Your client browses your website, selects the ideal item, makes a purchase, and eagerly awaits delivery. But then something goes wrong: the delivery is damaged, lost, or arrives late.

Here comes the dreaded bad review and possibly lost revenue in the future.

Do you recognize this? Then you are not by yourself. According to research, 20% of online orders are unsuccessful in reaching the buyer.

The difficulties in e-commerce logistics are changing as 2024 progresses, but so are the solutions. This post will outline the main logistics challenges that modern internet retailers must overcome and offer you tried-and-true methods to overcome them.

1. Handling Demand Seasonal Increases

Handling the sharp spike in demand over the holidays is a huge problem for companies who specialize in Christmas decorations.

A scarcity of goods, overloaded delivery systems, and frazzled customer support representatives might result from the seasonal uptick. Even while this surge is profitable, careful planning and strong logistics are necessary to make sure that operational snags don't taint the festive spirit.

Here's a clear action plan to successfully overcome seasonal demand fluctuations:

1. Boost demand projections.

Use past sales information to make precise demand predictions for the future. You can predict how much you'll need to satisfy client expectations without overstocking by using tools that examine trends and patterns.

2. Improve ties with suppliers.

Form reliable alliances with suppliers to make sure they can fulfill your heightened demands at the busiest time of year. Strive to get conditions that are negotiable and allow for last-minute changes based on actual demand.

3. Use technology to handle inventories.

Install cutting-edge real-time inventory management solutions. With the use of this technology, you may monitor stock levels at several places and quickly reallocate resources in the event that some things run low.

4. Increase the scope of your fulfillment plan.

To expedite delivery and control costs, include a variety of shipping partners and take into account temporary fulfillment sites located nearer to your primary markets.

Businesses can turn the difficulty of seasonal peaks into a chance for improved customer satisfaction and efficient operations by implementing these tactics.

2. Reducing Risk in the Management of High-Value Returns

Especially when it comes to expensive merchandise, handling returns effectively presents a distinct difficulty for luxury businesses that are recognized for their wonderful clothing and bags. To preserve the integrity of the product and satisfy customers, the procedure must be very cautious.

The risks are great: in addition to causing financial losses, a poorly managed return can harm the brand's reputation and the product itself.

This strategic strategy can help you handle high-value returns effectively:

1. Simplify the procedure for returns.

Make sure your return policy is simple, easy to understand, and available to customers. Simplify the return process while maintaining the greatest security and quality control standards at every stage.

2. Quality control inspections.

Upon return, do thorough checks to make sure the things are real and in good condition. at luxury goods, this stage is essential to ensuring that they may be sold at their full value or, if needed, restored.

3. Improved methods of packing.

Make a quality, long-lasting packaging investment for rewards. This guarantees the item's protection during transportation and preserves its excellent state.

4. Make use of technology to track.

Make use of sophisticated tracking solutions that let the client and the business keep an eye on the returned cargo. This openness eases consumer concerns and streamlines the return procedure.

By using these solutions, businesses can efficiently handle high-value returns, protecting the reputation of their brand and retaining customers.

3. Delivering and Installing Outdoor Structures Efficiently

The difficulty for businesses that create and market outdoor structures is making sure that installation and delivery go smoothly together.

This is crucial for this market segment since customer satisfaction is directly impacted by punctuality and appropriate assembly. The complexity rises with order size and customisation; accurate logistics planning is necessary to guarantee timely and flawless delivery of all components.

Brands can use these practical tactics to address the challenges associated with shipping and constructing huge outdoor structures:

1. Planning for logistics is optimized.

To effectively plan and track delivery routes, use sophisticated logistics software. To prevent delays or misunderstandings, make sure shipping schedules and installation appointments are precisely in sync.

2. Comprehensive installation instructions.

Give each package thorough, simple-to-follow installation instructions. Think about making online video tutorials that consumers may access straight from the package using QR codes.

3. Customer communication portal.

Provide a specific channel of communication for customers to follow the status of their orders, receive installation instructions, and get in touch with support staff—for example, a customer portal.

4. Installation teams' training.

Make sure your installation workers receive regular training on the newest methods for both assembly and customer service. This expedites the installation procedure and aids in meeting high standards.

Ensuring a seamless installation experience for all customers can be achieved by prioritizing effective communication and improving logistical cooperation.

4. Bulk Shipping of Oversized Items

Another major logistical problem in e-commerce is bulk-shipping large objects, which is especially prevalent in the outdoor structures specialty.

Businesses that specialize in supplies for gardening and greenhouses frequently struggle with the challenges of efficiently and affordably moving big, bulky materials.

These goods need extra room and cautious handling, which can greatly raise the cost of shipping and complicate logistics.

Here's how to successfully address this challenge:

1. Make the packaging design more efficient.

Create bespoke packaging that precisely matches the sizes and forms of your goods. By cramming more goods into each shipment, efficient packaging can save transportation costs by cutting down on wasted space.

2. Make use of consolidation of freight.

Shipments can be combined by using freight consolidation. By enabling the shipment of numerous items at once, this technique maximizes the amount of space in transportation trucks while cutting expenses.

3. Pick the ideal transportation associate.

Select logistics providers who have managed sizable shipments before. Seek out carriers who can accommodate growing businesses, have flexibility in load sizes, and have a solid track record with large commodities.

4. Put cutting-edge routing software into practice.

To plan the most effective delivery routes, use routing software. By optimizing driver routes, this technology helps to lower fuel expenses and delivery times.

By concentrating on these areas, you may enhance efficiency and customer satisfaction while reducing costs by optimizing the logistics for bulky commodities.

5. Transporting Fragile Goods Worldwide Safely

International shipping of delicate goods is a significant logistical barrier for e-commerce.

Because they are delicate, items like artisan pottery and home décor need to be handled with special care. Damaged items from improper handling during shipping can cause unhappy customers and expensive refunds.

Here's how to make sure delicate goods arrive at their destinations undamaged:

1. Make a quality package purchase.

Make use of sturdy, high-quality packaging materials. Use the double-boxing technique, in which the product is put into a smaller box and then sealed inside a larger box that has plenty of padding, such as bubble wrap or foam.

2. Select specialty carriers.

Collaborate with transportation companies who know how to handle delicate cargo. Consider their methods of handling and select those that provide specialist services for fragile items instead of making your decision solely on price.

3. Obtain shipment insurance.

Always have your packages insured. Make it obvious to your clients that all breakables are covered by insurance to build their faith in your support.

4. Observe and make adjustments.

Keep a close eye on the shipping procedure and ask clients about how their things arrived and what state they left them in. Make regular adjustments to your handling and packing procedures using this data.

Businesses may reduce risks and guarantee the safe delivery of their expensive, fragile goods by putting these procedures into place.

6. Handling Interruptions in the Supply Chain

Disruptions in the supply chain can have a big effect on companies that use specialty materials.

Because the materials and fabrics used to make these products are distinctive and legitimately sourced from certain areas, the supply chain is intricate and susceptible to disruptions. Any disruption, whether brought on by pandemics, natural disasters, or unstable political environments, can impede sales and cause manufacturing delays.

Here's how companies can tackle this problem:

1. vary your sources: To prevent being overly dependent on one provider, vary your sources. If there is a disruption to one supplier, this tactic can assist reduce risks. Build ties with other providers of the same raw materials who are located in various places.

2. Improve the handling of inventories.

Put strong inventory management procedures into action. Make better use of forecasting tools to estimate demand, and have safety supplies of essential commodities on hand to protect against supply chain interruptions.

3. Make supplier ties stronger.

Establish a solid working connection of cooperation with your providers. Frequent communication can aid in foreseeing any problems and identifying solutions fast. Take into account long-term agreements to provide a more reliable supply chain.

4. Make a supply chain visibility investment.

Make use of technology to see your supply chain in real time. Systems that track materials from the point of origin to the point of production enable you to respond more quickly by warning you in advance of delays or problems.

Put these strategies into practice to effectively manage your distinct supply chain. In this manner, even in the face of disruptions, you'll be able to preserve the caliber and accessibility of your high-end products.

Last Words

The tactics we've covered here go beyond simple fixes. They present chances to revolutionize your business and take the lead in your industry.

Here comes the dreaded bad review and possibly lost revenue in the future.

Do you recognize this? Then you are not by yourself. According to research, 20% of online orders are unsuccessful in reaching the buyer.

The difficulties in e-commerce logistics are changing as 2024 progresses, but so are the solutions. This post will outline the main logistics challenges that modern internet retailers must overcome and offer you tried-and-true methods to overcome them.

1. Handling Demand Seasonal Increases

Handling the sharp spike in demand over the holidays is a huge problem for companies who specialize in Christmas decorations.

A scarcity of goods, overloaded delivery systems, and frazzled customer support representatives might result from the seasonal uptick. Even while this surge is profitable, careful planning and strong logistics are necessary to make sure that operational snags don't taint the festive spirit.

Here's a clear action plan to successfully overcome seasonal demand fluctuations:

1. Boost demand projections.

Use past sales information to make precise demand predictions for the future. You can predict how much you'll need to satisfy client expectations without overstocking by using tools that examine trends and patterns.

2. Improve ties with suppliers.

Form reliable alliances with suppliers to make sure they can fulfill your heightened demands at the busiest time of year. Strive to get conditions that are negotiable and allow for last-minute changes based on actual demand.

3. Use technology to handle inventories.

Install cutting-edge real-time inventory management solutions. With the use of this technology, you may monitor stock levels at several places and quickly reallocate resources in the event that some things run low.

4. Increase the scope of your fulfillment plan.

To expedite delivery and control costs, include a variety of shipping partners and take into account temporary fulfillment sites located nearer to your primary markets.

Businesses can turn the difficulty of seasonal peaks into a chance for improved customer satisfaction and efficient operations by implementing these tactics.

2. Reducing Risk in the Management of High-Value Returns

Especially when it comes to expensive merchandise, handling returns effectively presents a distinct difficulty for luxury businesses that are recognized for their wonderful clothing and bags. To preserve the integrity of the product and satisfy customers, the procedure must be very cautious.

The risks are great: in addition to causing financial losses, a poorly managed return can harm the brand's reputation and the product itself.

This strategic strategy can help you handle high-value returns effectively:

1. Simplify the procedure for returns.

Make sure your return policy is simple, easy to understand, and available to customers. Simplify the return process while maintaining the greatest security and quality control standards at every stage.

2. Quality control inspections.

Upon return, do thorough checks to make sure the things are real and in good condition. at luxury goods, this stage is essential to ensuring that they may be sold at their full value or, if needed, restored.

3. Improved methods of packing.

Make a quality, long-lasting packaging investment for rewards. This guarantees the item's protection during transportation and preserves its excellent state.

4. Make use of technology to track.

Make use of sophisticated tracking solutions that let the client and the business keep an eye on the returned cargo. This openness eases consumer concerns and streamlines the return procedure.

By using these solutions, businesses can efficiently handle high-value returns, protecting the reputation of their brand and retaining customers.

3. Delivering and Installing Outdoor Structures Efficiently

The difficulty for businesses that create and market outdoor structures is making sure that installation and delivery go smoothly together.

This is crucial for this market segment since customer satisfaction is directly impacted by punctuality and appropriate assembly. The complexity rises with order size and customisation; accurate logistics planning is necessary to guarantee timely and flawless delivery of all components.

Brands can use these practical tactics to address the challenges associated with shipping and constructing huge outdoor structures:

1. Planning for logistics is optimized.

To effectively plan and track delivery routes, use sophisticated logistics software. To prevent delays or misunderstandings, make sure shipping schedules and installation appointments are precisely in sync.

2. Comprehensive installation instructions.

Give each package thorough, simple-to-follow installation instructions. Think about making online video tutorials that consumers may access straight from the package using QR codes.

3. Customer communication portal.

Provide a specific channel of communication for customers to follow the status of their orders, receive installation instructions, and get in touch with support staff—for example, a customer portal.

4. Installation teams' training.

Make sure your installation workers receive regular training on the newest methods for both assembly and customer service. This expedites the installation procedure and aids in meeting high standards.

Ensuring a seamless installation experience for all customers can be achieved by prioritizing effective communication and improving logistical cooperation.

4. Bulk Shipping of Oversized Items

Another major logistical problem in e-commerce is bulk-shipping large objects, which is especially prevalent in the outdoor structures specialty.

Businesses that specialize in supplies for gardening and greenhouses frequently struggle with the challenges of efficiently and affordably moving big, bulky materials.

These goods need extra room and cautious handling, which can greatly raise the cost of shipping and complicate logistics.

Here's how to successfully address this challenge:

1. Make the packaging design more efficient.

Create bespoke packaging that precisely matches the sizes and forms of your goods. By cramming more goods into each shipment, efficient packaging can save transportation costs by cutting down on wasted space.

2. Make use of consolidation of freight.

Shipments can be combined by using freight consolidation. By enabling the shipment of numerous items at once, this technique maximizes the amount of space in transportation trucks while cutting expenses.

3. Pick the ideal transportation associate.

Select logistics providers who have managed sizable shipments before. Seek out carriers who can accommodate growing businesses, have flexibility in load sizes, and have a solid track record with large commodities.

4. Put cutting-edge routing software into practice.

To plan the most effective delivery routes, use routing software. By optimizing driver routes, this technology helps to lower fuel expenses and delivery times.

By concentrating on these areas, you may enhance efficiency and customer satisfaction while reducing costs by optimizing the logistics for bulky commodities.

5. Transporting Fragile Goods Worldwide Safely

International shipping of delicate goods is a significant logistical barrier for e-commerce.

Because they are delicate, items like artisan pottery and home décor need to be handled with special care. Damaged items from improper handling during shipping can cause unhappy customers and expensive refunds.

Here's how to make sure delicate goods arrive at their destinations undamaged:

1. Make a quality package purchase.

Make use of sturdy, high-quality packaging materials. Use the double-boxing technique, in which the product is put into a smaller box and then sealed inside a larger box that has plenty of padding, such as bubble wrap or foam.

2. Select specialty carriers.

Collaborate with transportation companies who know how to handle delicate cargo. Consider their methods of handling and select those that provide specialist services for fragile items instead of making your decision solely on price.

3. Obtain shipment insurance.

Always have your packages insured. Make it obvious to your clients that all breakables are covered by insurance to build their faith in your support.

4. Observe and make adjustments.

Keep a close eye on the shipping procedure and ask clients about how their things arrived and what state they left them in. Make regular adjustments to your handling and packing procedures using this data.

Businesses may reduce risks and guarantee the safe delivery of their expensive, fragile goods by putting these procedures into place.

6. Handling Interruptions in the Supply Chain

Disruptions in the supply chain can have a big effect on companies that use specialty materials.

Because the materials and fabrics used to make these products are distinctive and legitimately sourced from certain areas, the supply chain is intricate and susceptible to disruptions. Any disruption, whether brought on by pandemics, natural disasters, or unstable political environments, can impede sales and cause manufacturing delays.

Here's how companies can tackle this problem:

1. vary your sources: To prevent being overly dependent on one provider, vary your sources. If there is a disruption to one supplier, this tactic can assist reduce risks. Build ties with other providers of the same raw materials who are located in various places.

2. Improve the handling of inventories.

Put strong inventory management procedures into action. Make better use of forecasting tools to estimate demand, and have safety supplies of essential commodities on hand to protect against supply chain interruptions.

3. Make supplier ties stronger.

Establish a solid working connection of cooperation with your providers. Frequent communication can aid in foreseeing any problems and identifying solutions fast. Take into account long-term agreements to provide a more reliable supply chain.

4. Make a supply chain visibility investment.

Make use of technology to see your supply chain in real time. Systems that track materials from the point of origin to the point of production enable you to respond more quickly by warning you in advance of delays or problems.

Put these strategies into practice to effectively manage your distinct supply chain. In this manner, even in the face of disruptions, you'll be able to preserve the caliber and accessibility of your high-end products.

Last Words

The tactics we've covered here go beyond simple fixes. They present chances to revolutionize your business and take the lead in your industry.

Avoid waiting for the next hiccup to compel you to act. Act now to protect your company's future, improve customer satisfaction, and strengthen your logistics.

Source material:

Kangur, K. (2024, May 7). Ecommerce Logistics: Challenges and Solutions for 2024. Global Trade Magazine. https://www.globaltrademag.com/ecommerce-logistics-challenges-and-solutions-for-2024/

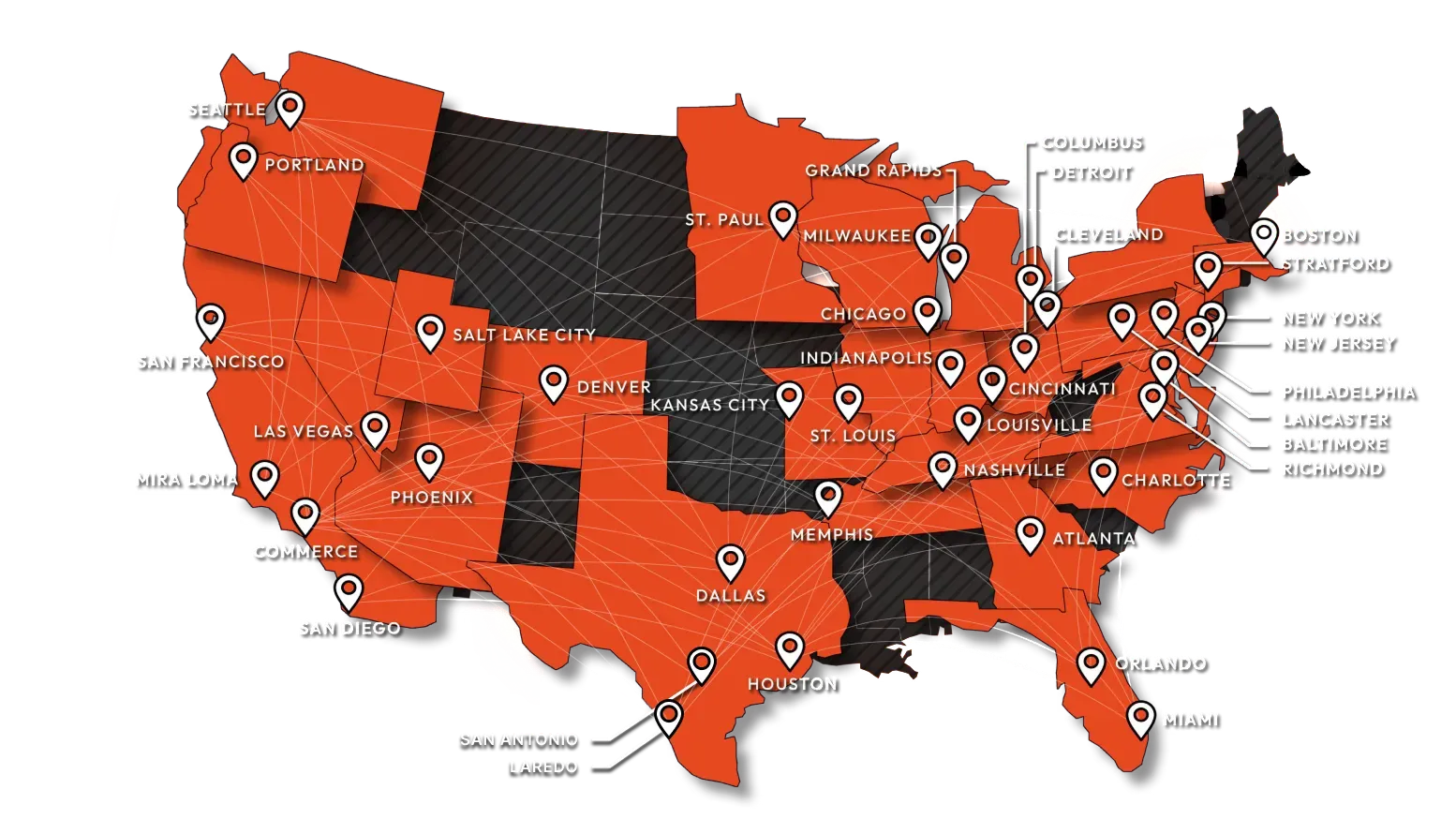

If your business ships products that are too large for small-parcel carriers but too small to fill an entire semi-truck, then LTL freight shipping—short for Less-Than-Truckload freight—is the perfect solution. LTL is quickly becoming one of the most cost-effective and efficient ways to move freight across the country. At White Wolf Logistics, Inc., we specialize in delivering reliable, affordable, and stress-free LTL shipping services that keep your business moving. ________________________________________ What Exactly Is LTL Freight? LTL freight shipping allows multiple businesses to share space on the same freight truck. Instead of paying for an entire truck you don’t need, your shipment uses only the trailer space required, and other shippers fill the rest. Think of LTL shipping as carpooling for freight — everyone shares the truck and everyone saves. ________________________________________ How Does LTL Freight Shipping Work Through White Wolf Logistics? Booking LTL freight with White Wolf Logistics, Inc. is simple and efficient: 1. Request a quote or schedule a shipment 2. We arrange pickup at your business 3. Your pallets or crates move through our trusted carrier network 4. Your shipment is delivered on time where you need it Because we partner with reliable, vetted LTL carriers, our customers enjoy speed, flexibility, and competitive pricing — without the headaches of managing freight on their own. ________________________________________ Benefits of Shipping Products via LTL Freight Whether you’re new to LTL or you’ve been shipping for years, the advantages are hard to ignore. ✔ Save Money With Less-Than-Truckload shipping, you only pay for the space your freight uses. No wasted space = no wasted budget. ✔ Ship What You Need, When You Need No need to wait until you can fill a truck. LTL lets you ship one pallet or multiple pallets anytime. ✔ Eco-Friendly Shipping Shared freight space means fewer trucks on the road and a smaller carbon footprint — perfect for sustainability-focused companies. ✔ Flexible Delivery Options LTL offers services that make delivery easy, including: • Liftgate service • Appointment scheduling • Inside pickup & delivery • Residential delivery ✔ Full Tracking & Visibility Every LTL freight shipment includes tracking updates so you know exactly where your freight is every step of the way. ________________________________________ Why Customers Choose White Wolf Logistics for LTL Freight Shipping Businesses choose White Wolf Logistics, Inc. because we make LTL shipping simple, affordable, and dependable. 🔹 Highly competitive freight rates We negotiate the lowest LTL pricing so your business saves on every shipment. 🔹 A strong network of trusted LTL carriers We only work with proven carriers known for reliability, safety, and on-time delivery. 🔹 A customer-first approach Our team handles the logistics so you can focus on running your business — not chasing down freight issues. 🔹 One point of contact No jumping between carriers or call centers — your logistics support team is always just one call or email away. 🔹 Fast quotes and quick booking We make shipping easy, transparent, and stress-free. ________________________________________ Final Thoughts: Choose White Wolf Logistics, Inc. for Your LTL Shipping Needs If your business wants to ship efficiently, affordably, and confidently, LTL freight shipping through White Wolf Logistics, Inc. is the smart choice. From a single pallet to recurring nationwide shipments, our logistics team ensures your products get where they need to be — on time and at the best price possible. ________________________________________ Ready to ship smarter? Just tell us what you're shipping, and White Wolf Logistics, Inc. will take care of the rest. Request a LTL quote here: https://www.whitewolflogistics.com/ltl---quote-request

Freight's Current Reality: The freight business is going through what analysts call one of the most interesting times in its history—but not in a good way for most participants. Motor carriers and freight brokers across the spectrum are suffering from low freight volumes and a fast changing operating environment. The current situation seems like the calm before a major storm, indicating a potential significant capacity washout in transportation history. With the risk of the market losing 600,000 active drivers, the largest capacity purge in history might occur, resulting in COVID-like spot rates. The difference this time is that Biden's open borders will not result in a flood of immigrants, as they did previously, which provided an inexhaustible supply of truck drivers. The capacity relief valve for shippers and brokers is permanently closed, requiring carriers to pay up in the form of greater compensation and bonuses for truck drivers. Finding capacity will also become increasingly challenging. Freight volumes have plummeted, with an 18% drop year on year. This abrupt reduction has posed significant issues for motor carriers seeking loads and freight brokers working with low volume to sustain their operations. This situation is particularly serious for brokers exposed to the spot market, as the scarcity of freight offers minimal profit margins. Moreover, the contract market presents significant challenges, as numerous brokers secure deals at unviable low prices while contending with asset-based carriers. As a result, the system has left many individuals struggling, which is unsustainable. Smaller motor carriers face fresh obstacles, especially those that have employed non-domiciled CDL drivers who might struggle to comply with regulatory demands like the English Language Proficiency (ELP) mandate. Fraud continues to grow as criminals figure out how to reverse engineer Highway and RMIS systems. As a consequence, there has been a notable increase in fraud, leading brokers to be cautious of potential scams and no longer disregarding even subtle indicators. Even the most credible carriers may suffer if their compliance checking systems produce false positives. Carriers identified by these fraud prevention systems could be prohibited from participating in almost any brokerage freight, potentially jeopardizing carriers struggling to stay afloat. Capacity Purge and Regulatory Changes: The projected "great purge" of capacity is the result of multiple converging circumstances, the most notable of which are recent changes in US immigration policy and enforcement. According to J.B. Hunt research, these policy changes, particularly those affecting non-domiciled Commercial Driver's Licenses (CDLs) and English Language Proficiency requirements, are expected to remove between 5% and 12% of CDL holders (214,000-437,000 drivers) from the US supply over the next two to three years. On September 26, 2025, the Federal Motor Carrier Safety Administration (FMCSA) issued an emergency order restricting the issuance and renewal of non-domiciled CDLs. The FMCSA forecasts that 97% of the current 200,000 non-domiciled CDL holders will be unable to meet the new requirements, causing them to leave the business within the next one to three years. This accounts for around 5% of all registered CDLs in the United States. Concurrently, tougher enforcement of English Language Proficiency standards has resulted in over 23,000 infractions, including more than 5,000 out-of-service orders. According to industry expert Avery Vise, this crackdown alone has the potential to eliminate about 20,000 drivers from the workforce yearly. According to transport economist Noël Perry, the total at-risk population could exceed 600,000 drivers, including those affected by non-domiciled CDL restrictions and ELP enforcement, as well as undocumented and new hire restrictions. This represents approximately 17% of active drivers. Carriers that rely on immigrant labor or do not meet the new criteria are likely to go out of business. Economic Implications of Capacity Purge: The combination of legislative reforms and extended freight recession circumstances is creating a climate conducive to considerable industry disruption. As financial constraints rise, industry insiders predict that several carriers and brokers may declare bankruptcy in the coming months. The market rationalization that will follow this capacity purge will most likely benefit the largest asset carriers, who have the wherewithal to weather the storm and adjust to the new regulatory framework. This is a dramatic departure from the prior market dynamic, in which the availability of truck drivers provided through immigration allowed many small operators to increase their fleets without conforming to customary operational norms. During the market recovery, motor carriers will have to provide increased driver compensation and incentives to attract qualified drivers from a diminishing pool of suitable candidates. This shift toward a more classic supply-demand balance may eventually lead to increased profitability for surviving carriers, but the transition period will definitely be difficult. Navigating the road ahead: Freight's path to recovery: The freight sector is on the verge of a transformational age. The predicted capacity washout, caused by regulatory changes and prolonged market instability, would most likely result in increased spot prices and stable contract rates as the market rebalances. While the timetable for this shift is unknown, the end result points to a market that functions on more classic supply and demand principles. For shippers, this entails planning for future pricing volatility and capacity limits. For carriers, particularly those that can manage the regulatory framework, it represents an opportunity to return to more sustainable operating circumstances following a prolonged period of market turbulence. Hold on to your hat if volumes pop, which it hasn't yet. It'll be one of the best freight markets carriers have seen in a long time. Although the path to that stage will be challenging, the industry could emerge more robust and stable after this extensive capacity purification is completed. FreightWaves, C. F. C. A. (2025, October 30). Largest capacity purge in history coming. FreightWaves. https://www.freightwaves.com/news/largest-capacity-purge-in-history-coming

When it comes to shipping freight, every penny counts. Whether you’re moving pallets across the state or across the country, the cost of freight shipping can add up quickly—especially when it comes to LTL (Less-than-Truckload) shipping. That’s why smart businesses turn to White Wolf Logistics, Inc. We’re not just another 3PL (third-party logistics provider)—we’re your partner in lowering shipping costs while delivering the kind of unmatched customer service that keeps your supply chain running smoothly. Why LTL Shipping Costs More Without a Freight Broker LTL freight shipping is one of the most cost-effective ways to move smaller shipments, but going directly to carriers can leave you paying higher base rates, inflated fuel surcharges, and unexpected accessorial fees. As an experienced LTL freight broker, White Wolf Logistics has the leverage to negotiate deeply discounted freight rates with our nationwide network of trusted carriers. Those savings get passed directly to you. Here’s how we keep your shipping costs down: - Discounted LTL freight rates thanks to our high-volume contracts. - Lower fuel surcharges compared to going direct to carriers. - Transparent pricing—no hidden fees or last-minute surprises. - Optimized freight routes to ensure faster transit times at lower costs. The result? On average, our customers save 20–30% on LTL freight shipping simply by routing through White Wolf Logistics instead of booking directly. Freight Savings Without Sacrificing Service At White Wolf Logistics, we know that price is only half the story. Many brokers can talk about discounts, but service is where we truly set ourselves apart. Here’s what makes our service the best in the freight shipping industry: - Dedicated account management—you’ll always have a real logistics expert managing your freight. - 24/7 shipment tracking and visibility for peace of mind. - Proactive problem-solving—if an issue arises, we fix it before it becomes costly. - Custom freight solutions designed around your unique shipping needs. We don’t just move freight—we build lasting partnerships with businesses that want to save money and ship smarter. Why Choose White Wolf Logistics as Your LTL Freight Broker? The answer is simple: we save you money and deliver unmatched service. Instead of paying inflated carrier-direct rates, you can take advantage of discount freight shipping through White Wolf’s extensive carrier network. And unlike other 3PLs, we put customer service first. Whether you’re shipping LTL freight, full truckload (FTL), or specialized freight services, White Wolf Logistics, Inc. gives you: - Lower freight costs - Faster, more reliable shipping - Service you won’t find anywhere else - Start Saving on Your Freight Shipping Today Don’t let high shipping costs eat into your bottom line. With White Wolf Logistics, Inc., you’ll enjoy real savings on freight shipping without sacrificing service. From discounted LTL freight to fully customized logistics solutions, we make shipping smarter, easier, and more affordable. 📞 Call us today at (805-744-7585) to get your free freight quote. 💻 Or visit www.WhiteWolfLogistics.com

Why a 3PL (Freight Broker) is the Secret Weapon Your Business Needs Let’s be real—shipping freight isn’t exactly a hobby anyone brags about. Between negotiating truckload freight rates, coordinating LTL shipping, and trying to figure out why your pallet is “in transit” for three days longer than planned, logistics can be a nightmare. That’s why smart businesses use a third-party logistics provider (3PL)—better known as a freight broker—to handle the chaos. Think of a 3PL like White Wolf Logistics as your personal freight problem-solver. They connect shippers with carriers, secure the best rates, and make sure your freight moves smoothly without you pulling your hair out. ________________________________________ What is a 3PL, Anyway? A 3PL (third-party logistics provider) is a company that manages the shipping process for you. Instead of calling carriers one by one, hoping for decent rates, a freight broker uses their carrier network and industry leverage to lock in discounted freight shipping rates—for both LTL freight and truckload freight. It’s like buying in bulk at Costco—except instead of toilet paper, you’re saving on freight costs. ________________________________________ The Benefits of Using a Freight Broker Here’s why partnering with a 3PL is a no-brainer for your business: Freight Savings You Can See: Carriers offer brokers volume discounts. Instead of paying retail freight rates, your shipments ride on wholesale pricing. That means real cost savings on every truckload and LTL shipment. LTL Shipping Made Simple: Less-than-truckload freight can be confusing. A good 3PL makes it easy by finding the best LTL carrier for your lane and budget. Truckload Freight Without the Stress: Whether you need a dry van, flatbed, or reefer, your broker has pre-vetted carriers ready to roll. Paperwork? Done. Bill of lading, rate confirmations, and carrier compliance—your broker handles the boring stuff so you don’t have to. Proactive Communication: No more chasing carriers for updates. A good broker keeps you informed so you always know where your freight is. Problem-Solving Pros: Liftgate issue? Missed appointment? Delays? Freight brokers are masters at smoothing out shipping headaches. ________________________________________ What You Should Expect from Your Freight Broker If you’re trusting a 3PL with your shipments, here’s what you should demand: • Clear Freight Quotes with no surprise “accessorial” charges. • Multiple Options so you can choose between cheapest, fastest, or most reliable carriers. • Real Customer Service, not just call-center scripts. You want a logistics partner that knows your business. • Consistency, Transparency, and Reliability on every shipment. When you work with White Wolf Logistics, that’s the standard. ________________________________________ Why Not Just Go Direct to Carriers? Sure, you can go directly to carriers. But here’s the catch: carriers quote you “rack rates”—basically the sticker price of freight. With a 3PL, you get access to discounted freight rates thanks to the broker’s volume buying power. So instead of paying top dollar, you save money on every shipment. Plus, you’re not limited to one carrier’s network—you get flexibility, competitive pricing, and multiple shipping options with a broker. It’s like the difference between paying full price at the box office versus getting VIP tickets at half the cost. ________________________________________ The Bottom Line: Call the Wolf! We can be reached at 805-744-7585. Or request a quote here At the end of the day, working with a freight broker (3PL) like White Wolf Logistics isn’t just convenient—it’s cost-effective. You’ll save money, simplify your supply chain, and ship smarter. Whether you’re moving LTL freight, truckload freight, or anything in between, let the logistics experts at White Wolf Logistics handle the freight chaos so you can focus on growing your business. Stop overpaying for shipping. Call the Wolf.

Roadrunner's long-haul LTL network is strengthened by recent additions. Less-than-truckload carrier On Thursday, Roadrunner declared that it had expanded its network by over 100 lanes and made Kansas City a key hub. Lane additions occurred in all of the major U.S. geographic regions, but the Midwest's industrialization was the most notable. According to Roadrunner, its new Kansas City hub now offers direct connectivity to the majority of important Midwest markets. Additionally, Roadrunner (OTC: RRTS) enhanced network connectivity from the Northeastern, Southern, and Western U.S. to the nation's interior. In a news release, Tomasz Jamroz, president and chief operating officer, stated, "The addition of new lanes into our Smart Network speaks volumes about the level of service we're delivering." "This expansion brings us one step closer to our objective of becoming the nation's leading long-haul LTL carrier." According to Jamroz, the business just recorded record increases in its service metrics for the fourth consecutive month. Additionally, Roadrunner added more than 21,000 miles of coverage in the US and Canada to its list of guaranteed services. Houston to Atlanta, Philadelphia to Dallas, Seattle to Dallas, San Francisco to Chicago, and several originations from Commerce, California, and Milwaukee are among the new guaranteed lanes. There are now over 60 guaranteed lanes for the carrier. Roadrunner's vice president of linehaul operations, Shari Leon, stated, "Our dedication to a direct-run Smart Network gives shippers more control and reliability — especially as others in the market contract." According to Leon, the extended service is cutting down on shipment handoffs and speeding up transit, which reduces damage. "This expansion into cities with high demand demonstrates the effectiveness of our over-the-road model and precise linehaul planning," Leon stated. In March, the business expanded its long-haul, direct metro-to-metro network by adding 278 lanes. With more than 40 terminals and more than 1,000 independent drivers, Roadrunner has a nationwide LTL service footprint. Maiden, T. (2025b, July 24). Roadrunner adds over 100 lanes, establishes Kansas City hub. FreightWaves. https://www.freightwaves.com/news/roadrunner-adds-over-100-lanes-establishes-kansas-city-hub

The Great LTL Shake-Up Is Here! The National Motor Freight Classification (NMFC) system stopped using its old, commodity-based pricing methodology on Saturday, July 19. Instead, it switched to a simpler density-first structure. This is a big change. It's a huge change in how LTL freight is sorted and charged. Keith Peterson, the NMFTA's Director of Operations, remarked, "This docket is really the biggest we've ever put out." "It had 99 proposals that affected more than 2,000 items." It was a big one. Let's look at what's changing, what it means for your operations, and who is best able to handle the changes. What Happened? Size is now the most important thing in freight class. Pallets with low density that used to be cheap might now be more expensive, whereas shipments with high density might get a break. The amount of space your freight takes up on the truck is what matters. Out with the Old: More than 2,000 specific item types have been removed or combined. In with Density: Freight will now be mostly sorted by density instead of by type of good. Ready for API: NMFTA started using digital technologies like ClassIT+ and GetClassification.com to keep shippers, carriers, and 3PLs up to date. What This Means: A lot of brokers and shippers are saying "chaos." You might already be getting furious emails from your clients if their freight is suddenly being charged at a higher class. Expect: A rise in arguments about classifying Carrier salespeople using the new mechanism to get higher rates approved Operational teams are rushing to recalculate margins in the middle of a load. For those that have prepared by revising item numbers, retraining staff, and using NMFTA's APIs, now is their time to shine. Rates Are Going Up Already Before the NMFC modification, LTL prices were already going up: The TD Cowen/AFS LTL index is expected to reach an all-time high in the third quarter, 66% higher than in 2018. Even if volumes are going up and down, carriers are being strict about rates and managing their revenue better. The new NMFC framework gives carriers another way to explain changes in prices. Aaron LaGanke, VP of Freight Services at AFS, said, "The NMFC transition to a density framework should give carriers another way to tightly manage freight classification and pricing." At the same time, the weight of each cargo is going down, and rebills are likely to go up. If shippers aren't careful, this is a typical case of "less for more." Who's Winning in LTL Right Now? This change in the rules is happening when freight markets are clearly going in different directions. LTL carriers are able to set prices, but TL fleets are still feeling the effects of the recession. Our recent assessment of the Top 100 For-Hire Carriers shows that LTL titans are holding their own and even rising in some cases: XPO, Estes Express, and Old Dominion all did better than or stayed the same in their ranks. Schneider and TFI International, which are TL-heavy carriers, fell because of low volumes and bad profits. FedEx is also getting ready to split off its LTL operation, hoping that it can do well on its own. In a market that is always changing, LTL is becoming an important part of margin management. And the NMFC reform just made things even more important. Pulley, A. (2025, July 23). New LTL Math. FreightCaviar. https://www.freightcaviar.com/new-ltl-math/?ref=the-freightcaviar-newsletter

Supply chains are already having to be ready for another strong hurricane that is predicted to make landfall on Wednesday, less than two weeks after Hurricane Helene ravaged areas of the Southeast United States. According to the National Hurricane Center, Hurricane Milton quickly strengthened into a Category 5 hurricane on Monday morning and continued to grow as it moved into the Gulf of Mexico, reaching maximum sustained winds of 160 mph. When the hurricane reaches Florida's Gulf coast by late Wednesday, it is predicted to have weakened down to a Category 3. The storm is expected to reach its peak intensity Tuesday morning. In certain coastal areas, storm surges might be as high as eight to twelve feet. Governor Ron DeSantis urged those living along the western shore to evacuate during a press conference on Monday. He also mentioned that he expected a "flurry" of orders throughout the day. The National Hurricane Center predicts five to ten inches of rain across the Florida peninsula and the Keys through Wednesday night, with localized totals of up to fifteen inches. After Hurricane Helene, which killed 227 people in six states and was the deadliest hurricane to hit the U.S. mainland since Hurricane Katrina in 2005, supply systems are still in disarray. As the Category 4 hurricane made landfall on September 26, it tore apart the region as it proceeded from Florida's "Big Bend" northward through western Georgia and North Carolina and into Tennessee. Due to the massive floods that resulted, millions of people lost power and homes were washed away, roads were destroyed, and residences were destroyed. When the hurricane moved inland, it affected FedEx and UPS operations the most, with southern North Carolina being the hardest hit. There was limited service available for FedEx's express and ground delivery as of Friday in 529 ZIP codes located in North Carolina, South Carolina, Georgia, and Tennessee. In 213 ZIP codes in North Carolina, South Carolina, Georgia, and Florida, FedEx Freight offers limited or no service. FedEx did not provide service for two ZIP codes: Chimney Rock and Lake Lure, which are two of the places most affected by the flooding in North Carolina. These ZIP codes are the only two that UPS listed as affected as of Monday. The storm had a major impact on the U.S. textile manufacturing business as well, causing catastrophic damage to many enterprises and forcing others to shut down operations, according to Kimberly Glas, president and CEO of the National Council of Textile Organizations (NCTO). Some manufacturers were forced to shut down their operations due to power outages. A few sustained minor damage, such as roofs that needed to be repaired and trees that fell, Glas told Sourcing Journal. Then there are some when the difficulties were more serious. While making sure that their workers are safe and that their families are taken care of, we are working fast to get their operations back up and running. Following the devastation caused by the hurricane, Glass wrote to President Joe Biden on Thursday, requesting that his administration step in to stop the attack on the East and Gulf Coast ports. That evening, the parties reached a provisional pay deal, ending the three-day walkout. "Throughout the past few days, a large portion of the industry dealt with this. The workers, their families, their friends, and these communities are the top priorities for the American textile sector, according to Glas. "These American textile factories have been in operation in some of these communities for more than a century, and they frequently serve as the community's backbone." According to Glas, there have been 21 factory closures in the US textile industry in the last 18 months, which has put further pressure on the business on top of the twin events of Hurricane Helene and the port strike. However, she thinks the NCTO member businesses, which continue to employ 2 million people in the United States, will overcome the difficulties and supply chain interruptions. "This sector is robust. We have a large amount of merchandise that is ready to ship out to customers immediately," Glas said. "It's true that the industry will recover from some of this fairly quickly, but I don't want to minimize the difficulties that the storm has caused for everyone, particularly in that region of the nation." Hurricane Milton will significantly affect a number of businesses statewide, including general manufacturing, freight, aerospace and defense, life sciences, oil and gas, tech, and more, following Hurricane Helene. Resilinc, a provider of supply chain mapping and monitoring solutions, estimates that Milton will have an impact on 12,410 locations that handle tasks including fabrication, testing, warehousing, and manufacturing. Milton, according to Resilinc, will have an effect on the production of about 11,000 products and over 97,000 distinct parts that are in danger for everyday consumer goods. Taylor, G. (2024, October 7). Sourcing Journal. Sourcing Journal. https://sourcingjournal.com/topics/logistics/hurricane-helene-milton-relief-category-5-supply-chain-fedex-ups-textile-manufacturing-ncto-kimberly-glas-port-strike-530490/

Understanding Third-Party Logistics for Small Businesses: Find out how to use third-party logistics to grow and improve your fulfillment skills and get the most out of your business. You're ready to start your business, which you hope will be a success. You know what you have in stock. You know who your clients are. Prices are evened out. And your branding is top-notch in terms of both what it says and how it looks. But how are you going to get your goods to people who want to buy them? You will need to use the 3PL industry unless you want to start a shipping company to go along with your store. These companies are the modern-day champions of fulfillment. There are many types and sizes of 3PL logistics companies, and their services can vary between storage, shipping, and delivery services. Many can even be integrated into your inventory management software. Read on to find out more about 3PLs, including why they exist, their pros and cons, and what you should look for in a 3PL partner. In short: What are arrangements done by a third party? A third-party logistics (3PL) company works with retailers to make sure their products get to customers on time. 3PLs are great because they give small businesses like yours the same local, regional, national, and even foreign delivery power that big stores have built themselves. They can also deliver to and from warehouses and get your products to your customers' mailboxes or front doors. There have been a lot of changes in the small business retail market over the last 10 to 20 years thanks to the rise of 3PL providers. Small businesses have to do everything they can just to stay afloat while following best practices for inventory control. 3PLs are helpful for more than just small businesses. 3PLs have leveled the playing field for medium-sized and large stores, and these same retailers get a lot out of these services. They're almost as common as inventory management systems that use barcodes. The goal of all 3PL companies is to be as efficient as possible. That includes places to store and warehouse goods, ship to and from delivery centers, and finish the last steps needed to get products into the hands of customers. Three kinds of 3PLs At the most basic level, all 3PLs take care of moving your goods. There are, however, a lot of differences in the ways that that can happen. That's why we chose to focus on these three types of 3PL companies. 1. Full Service 3PL: A full-service 3PL company creates customized possibilities for each business they work with. As a merchant, a full-service 3PL provider gives you a wide range of services that go beyond the usual last-mile fulfillment or storage and distribution methods. A full-service 3PL is like a logistics concierge. Customized services give you more peace of mind, but they cost more than regular "store and ship" services because they offer more support. 2. Warehousing and Distribution 3PL: Most of the time, 3PL platforms are 3PL companies that store goods and offer delivery services. You get a professional storage space for your goods, expert shipping to certain areas, and even handling and management of returns, which includes adding the goods back to your stock. This type of 3PL service comes in many shapes, sizes, and prices. When you need to fulfill orders in a small area, you can use a local 3PL. When you need to fulfill orders all over the world, you can switch to a foreign 3PL. 3. 3PL companies that focus on transit A lot of businesses may only need transit services to move goods from one shop or warehouse to another. In this case, a 3PL service that focuses more on transit comes in handy. These service providers offer cheaper prices compared to others because all they do is move your goods from point A to point B. This could be anything from getting your raw materials to where you make your products to delivering your store's goods to your customers. Compared to the other two types of 3PLs, this may seem very small. However, it may be all you need if you're just starting out with shopping and fulfillment. Why 3PL is a great choice for your small business When you use 3PL services instead of trying to handle delivery on your own, you get some big benefits. What are three of the best things about 3PL? Make your fulfillment area larger. Having partnerships with 3PL providers is a great way to get into new areas. Businesses can now reach as many people as they want thanks to e-commerce and online shopping. And 3PLs solve the question of how to make money off of customers who aren't in your area. It's possible to make your fulfillment area as big as you want it to be—regional, national, or even worldwide. Stay flexible as you scale up and down. If you use a 3PL, you can grow your usable fulfillment area a lot faster than if you built your own shipping systems. And the great thing about 3PLs is that this scale can change very quickly. You can scale up during busy times or to handle new growth. On the other hand, you can scale down when you're out of goods or just need a break. Use their professional market knowledge to your advantage. A luthier is an expert at making custom guitars that are very complicated. Chefs are experts at putting together and cooking the right mix of items to make tasty food. You might be very good at knitting and making blankets, scarves, hoodies, and anything else that can be knitted. Each of these artists are very good at a different type of work, but they probably aren't very good at the processes needed for shipping and fulfilling orders. When you work with a 3PL, you can focus on what you do best and let the 3PL handle shipping. Bad things about 3PL There are some bad things about 3PLs, like most things in life. Here are some bad things about working with them. Giving up control of your fulfillment: One bad thing about outsourcing your fulfillment is that you're giving someone else your hard-earned brand exposure and value. One thing is for sure, though: if there are any problems with shipping, your customers will see that as your fault. Because they decided to do business with you instead of your 3PL, they will be right to expect you to pay them back. Set up shared processes: In the same way as the first drawback, you can't tell someone what they can't change. It's important to go over best practices with your 3PL partner, discuss them, negotiate them, and agree on them. This includes important details like where to leave your package (mailbox, front door, or around the back), how to handle returns, and what to do if a package is running late. Working with a 3PL might be most common in a situation where goods and fulfillment are spread out. The store owner never has a physical hold on their goods in this case. Products are sent to one or more warehouses after being bought from manufacturers. These third-party warehouses handle the delivery needs of online sales. The merchants can also see the purchase, but it is sent immediately to the 3PL to start the fulfillment process. The package is picked up, packed, and sent to the end customer. 3PL is very important to the growth of e-commerce. E-commerce has become more accessible to more people, which has helped businesses make more sales, but that's just the beginning. Behind the scenes, 3PL providers are the ones who really get things done. They organize and connect all the different orders into smart and profitable delivery plans. It's our duty to give them what they want. As business people, we need to get as much value as we can from these connections. Guinn, J. (2024, May 10). A Small Business Guide to Third-Party Logistics. The Motley Fool. https://www.fool.com/the-ascent/small-business/inventory-management/3pl/

Next month, the National Motor Freight Traffic Traffic Association schedules listening sessions for shippers, carriers, and third-party logistics companies. The National Motor Freight Traffic Association said the first phase of a National Motor Freight Classification revamp will start in Q1 of 2025. Using a uniform approach to LTL pricing based on density, handling, stowability, and liability, the improvements are meant to simplify the classification system. Three listening sessions on the modifications scheduled for next month by the NMFTA. First for LTL carriers on August 6; second for third-party logistics companies on August 7; last for shippers on August 8. These are not little tweaks to the rating system that LTL carriers use to decide their pricing. NMFTA projects that up to 3,500 single-class items will be transferred to 13 subcategories class system. Apart from simplifying the classification, the modifications also aim to improve user experience and boost productivity by lowering erroneous cargo classification. "We also concentrated on improving the user experience to make it easier to both use and understand the NMFC," stated Keith Peterson, NMFTA's director of operations in the statement. NMFTA reported that the process is expected to becoming increasingly intensive, educational, and inclusive as 2024 advances. "Both the NMFTA and NMFC expect the changes to streamline workflows, improve communication and visibility, and raise the general satisfaction of everyone involved," NMFTA said. Campbell, C. (2024, June 21). Freight classification overhaul to begin next year. Trucking Dive. https://www.truckingdive.com/news/national-motor-freight-code-changes-2025-nmfta-listening-sessions/719444/